Introduction to DeFi

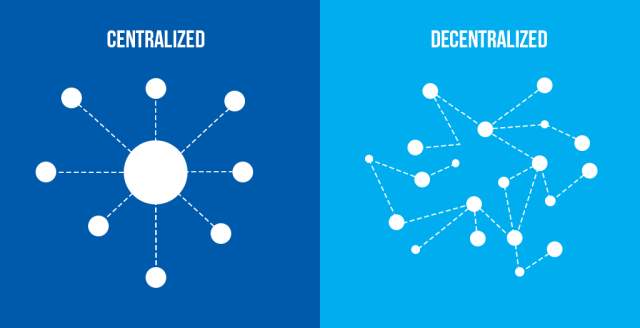

Decentralized Finance, or DeFi for short, isn’t just another buzzword floating around the complex world of finance today. It marks a pretty big shift from the old-school, centralized systems to something way more direct—we’re talking peer-to-peer finance thanks to the magic of technologies on the Ethereum blockchain. DeFi uses all the good stuff blockchains offer—like being permanent, transparent, and secure—to open up a financial system that anyone with internet access can dive into.

The Basic Components of DeFi

To really get the hang of why DeFi is such a game changer, it helps to know what it’s made of. At heart, DeFi is all about smart contracts, protocols, and decentralized apps (or dApps), all running on blockchain networks like Ethereum. Smart contracts are pretty much what they sound like: contracts that carry out themselves according to the code they’re written in. Protocols set the rules, and dApps give a neat interface to interact with these protocols and smart contracts. With these basics, DeFi projects can provide services like lending, borrowing, trading, and even insurance without needing traditional middlemen.

How DeFi Extends Beyond Cryptocurrencies

When most folks think of DeFi, cryptocurrency trading usually pops up first. But, oh boy, it goes way beyond just that. One of the coolest things about DeFi is how it opens the door to financial services to pretty much everyone globally. Take DeFi lending platforms, where you can lend your cryptocurrencies and get interest payments back, kind of like a digital bank’s savings account but without any bothersome middlemen. That means better efficiency and often juicier returns.

Additionally, DeFi’s got some innovative tricks up its sleeve like yield farming and liquidity mining, where users can earn rewards just for participating in these platforms. It’s a fantastic way for folks to earn a bit on the side using strategies that were once only available to the financial big guns.

Real-World Applications Making a Difference

The real-world impact of DeFi is pretty impressive. For starters, in places where the local currency isn’t that stable, or banking services are hard to come by, DeFi rolls in with stablecoins tied to steadier currencies like the US dollar, making life a tad easier for folks there.

Then there’s the whole thing about sending money back home—a huge deal for migrant workers. DeFi platforms can make these remittances way cheaper and faster than traditional banks. And there’s decentralized insurance which is shaking things up by skipping the middleman, potentially bringing down costs and making insurance more accessible to people worldwide.

Challenges Facing DeFi

Now, DeFi’s not perfect—there are some kinks to iron out. One biggie is scalability; Ethereum, where lots of DeFi stuff happens, sometimes gets bogged down when it’s busy, leading to high fees and slow processing times. And while smart contracts are usually super secure, a tiny coding slip-up can leave doors open for hackers.

Regulatory stuff is also starting to come up as governments begin to realize how disruptive blockchain can be. Figuring out these new rules will be crucial for DeFi’s growth. Plus, there’s this hurdle of getting folks up to speed on all things DeFi, which can be a bit daunting for newcomers.

The Future Potential of DeFi

Looking ahead, the sky’s the limit for DeFi. With tech improvements like layer 2 solutions sorting out those Ethereum traffic jams and more educational stuff helping folks get on board, we’re likely to see even cooler services popping up. Things like mortgage lending or complex trades could all start happening on blockchain.

And as these blockchains start playing nice with each other, things will only get smoother and cheaper. Plus, imagine mixing in some artificial intelligence—that could really spice things up with optimal investment strategies and real-time rate adjustments.

So, what do you think? Ready to jump into this new wave of finance? Drop us a line and let us know your thoughts!